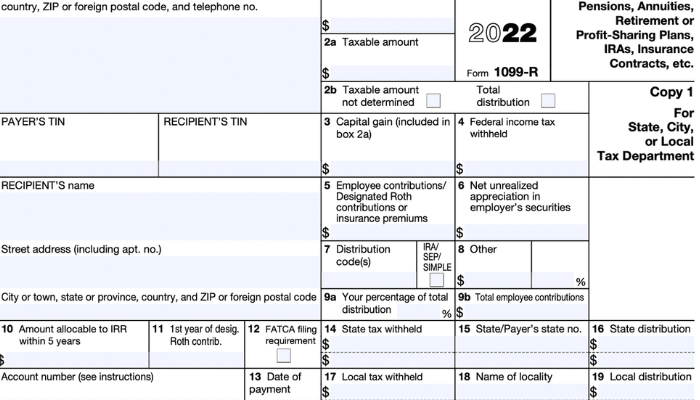

In order to submit to the Internal Revenue Service all the various types of money they receive throughout a fiscal year aside from their regular paycheck, American citizens can use the IRS Form 1099.

Dividends, interest, contract compensation, and other similar sources of income may all fall under this category of income, which is also referred to as income from sources unconnected to employment. But before we get into the matter of how to file a 1099 document and how to use a 1099 tax estimator, let’s first explore its other components.

Important Form 1099 characteristics

The primary objective of IRS form 1099 is to simplify the process by which US taxpayers report all of their revenue to the IRS so that the appropriate quantity of taxes can be gathered.

The Form 1099 is referred to by the IRS as a “information return.”

The Internal Revenue Service compares the revenue recorded by taxpayers on Form 1040 and the data on 1099 forms to the information it gathers itself. If the details are incorrect, the IRS sends the person a CP2000 notification informing them that they have tax payments due to the state.

Individual filers frequently neglect to complete the 1099 papers. The required 1099 forms should be filled out by financial organisations and businesses that use contract labor, and they should send them to the payees no later than the beginning of February.

The 1099 tax forms do not have to be sent to the IRS with a person’s tax return. However, they should keep them on file with their other financial records in case of an investigation.

There are 21 various variations of the IRS Form 1099, with some of the more well-known ones being Forms 1099-MISC, 1099-NEC, 1099-K, Form 1099-B, Form 1099-DIV, and so forth.

Now that we are acquainted with the fundamentals of the IRS Form 1099, let’s examine how to obtain one. If you need further information you can ask a tax expert.

A Concise Overview of How to Obtain a Form 1099

A 1099 document is delivered to an individual taxpayer by postal or internet means by the organisation that paid them for their services, such as a company, bank, brokerage, etc. It is suggested to get in contact with the company or organisation and ask for a recall if a person anticipates receiving a 1099 but does not when they ought to.

Payers, such as companies that pay workers or financial organizations, have until January 31 to file their 1099 forms. The forms are accessible for download on the IRS website, and hard copies are also available in any public courthouse or government building. What should I do if I lose my 1099 is a common query. With a 1099, you can always include the revenue on your tax report.

Now that we are aware of how to acquire a Form 1099 and all of its advantages, we can move on.

You can also check the IRS estimated tax payments by using a tax calculator for your specific states, like Georgia tax calculator, Washington tax calculator and Texas tax calculator.

Last lines

It would not be inaccurate to conclude that filing taxes takes a lot of effort. The numerous technicalities, legalese, and mechanical calculations required to calculate expected taxes and file forms can be mentally taxing. There are a few benefits of the Form 1099 that the general public might not be aware of. For instance, freelancers may take advantage of self-employment tax deductions to reduce their total tax load. In order to prevent receiving an IRS audit notification, it is always a good idea to choose professional assistance or to use tax calculation software.

Comments